- (1)

- Amounts calculated based on actual earnings during 2020 and include mid-year salary adjustments.

- (2)

- Mr. O'Donnell retired from the Company in June 2020 and received a partial payout of 25% of target under the 2020 STIP program.

- (3)

- Ms. Lind retired from the company in October 2020.

Long-Term Equity Compensation

Long-term equity incentives under the LTCP2020 LTIP consist of performance share units ("PSUs") and restricted stock appreciation rightsunits ("SARs"RSUs") granted on an annual basis, with stock appreciation rightsRSUs representing approximately 30%40% of the total value of the equity incentive awards and performance sharesPSUs representing approximately 70%60% of the total value of the equity award granted to an executive officer for that year.2020. This reflects the Company's desire to emphasize the performance basedperformance-based incentives in the LTCP.LTIP. The total target LTCPLTIP grants are set at the beginning of the year for each named executive

Table of Contents

officer at a minimum of 60%NEO with the 2020 LTIP grants ranging from 65% to 200% of the executive's base salary. The Company typically grants 100% of the SARsRSUs in conjunction with the first Board meeting of each fiscal year. Each year the Compensation Committee reviews and approves a target number of performance share unitsPSUs for each of our named executive officersNEOs and each other participant in the LTCPLTIP plan. The number of units actually earned by each participant is determined by the Company's corporate performance. performance during the applicable performance period.

The range of possible awards is set by the Compensation Committee based on its: (i) belief that a minimal award shallshould be granted if the

performance measures are significantly below target levels; and (ii) determination that the top end of the range provided an appropriate incentive for management to achieve exceptional performance.

The combination of SARsRSUs and performance share unitsPSUs focuses our executives on Neenah's financial performance and increasing shareholderstockholder value. It is aligned with and supports our stock ownership policy. Long-term incentives also helppolicy and helps retain employees duringfor the duration of the performance periods and vesting periods.

The Compensation Committee regularly reviews the Company's LTIP to identify opportunities to further align executive compensation with long-term stockholder value. In 2020, and in consultation with the compensation consultant, the Compensation Committee approved changes to the 2020 LTIP to remove the one-year performance period component of the PSU award, with 100% of the PSUs being subject to a three-year performance period ending on December 31, 2022.

2017 LTCPNeenah, Inc. 2021 Proxy Statement | 25

Table of Contents

2020 LTIP Awards

For 2017,2020, the Compensation Committee, consistent with our compensation philosophy, approved equity grants under the LTCPLTIP for our named executive officersNEOs with target values ranging from 60%65% to 200% of base salary paysalary.

The process described above resulted in grants of RSUs and PSUs in 2020 as follows:

| | | | |

| | 2017 LTCP

(% of base Salary) | |

|---|

O'Donnell

| | | 200 | % |

Lind

| | | 80 | % |

Schertell

| | | 80 | % |

Heinrichs

| | | 70 | % |

Duncan

| | | 60 | % |

| | | | | | | | | | | | | | | | |

Name |

| 2020 LTIP

(% of Base Salary) |

| 2020 RSUs |

| 2020 PSUs |

|

John P. O'Donnell (ret.) | | |

200 | | | |

12,475 |

(1) |

| |

— | | |

Julie A. Schertell | |

|

200 |

|

|

|

8,889 |

(2) |

|

|

13,333 |

|

|

Bonnie C. Lind (ret.) | | |

100 | | | |

4,716 |

(1)(3) |

| |

— | | |

Paul F. DeSantis | |

|

100 |

|

|

|

4,471 |

|

|

|

6,707 |

|

|

Byron J. Racki | | |

75 | | | |

1,735 | | | |

2,602 | | |

Michael W. Rickheim | |

|

65 |

|

|

|

2,272 |

|

|

|

3,407 |

|

|

Noah S. Benz | | |

65 | | | |

1,357 | | | |

2,035 | | |

- (1)

- Reflects pro-rated award based on the date of retirement.

- (2)

- Includes award of 4,032 RSUs in connection with Ms. Schertell's appointment as President and Chief Executive Officer on May 21, 2020.

- (3)

- 100% of Ms. Lind's 2020 LTIP award was converted to RSUs on Ms. Lind's date of retirement.

For each of our named executive officers,NEOs, the value was divided into awards of SARsRSUs and a target number of performance share units,PSUs, with 70%60% of the value in performance share unitsPSUs and 30%40% of the value in SARs.RSUs. The range of possible awards under the LTCPLTIP was selected to tie a substantial percentage of theireach NEOs compensation to Neenah's performance.

The number of SARsRSUs to be awarded to each named executive officerNEO in 20172020 was determined by dividing the value of the portion of the LTCPLTIP award to be awarded as SARsRSUs (determined by the Compensation Committee as described above) by the grant date fair value of onethe Company's stock option (determined using a modified Black-Scholes formula),on the day of the grant, and then rounded to the nearest share to produce the number of shares subject to the applicable optionRSU award. Each grant of SARsRSUs made in 20172020 vests in increments of 33.34%, 33.33% and 33.33% over a three yearthree-year period, with vesting occurring on each anniversary of the applicable grantDecember 31, 2020, December 31, 2021 and a ten year term to exercise. December 31, 2022.

The process described above resulted in grants of SARs in 2017 as follows:

| | | | |

| | 2017 SARs | |

|---|

O'Donnell

| | | 36,753 | |

Lind

| | | 7,262 | |

Schertell

| | | 7,085 | |

Heinrichs

| | | 5,657 | |

Duncan

| | | 3,720 | |

In 2017 the Compensation Committee approved an amendment to the performance sharePSU portion of the LTCPLTIP program to incorporateincorporates a three yearthree-year performance period for a portion of the incentive. Twenty Five percent of the total award is measured over a three yearand vesting period, further aligning senior management of the Company with long term shareholderlong-term stockholder interests. The remaining seventy five percent of the award retains a one-year performance period to focus on and reward annual growth in sales,

Table of Contents

earnings per share and return on invested capital. The target number of performance share unitsPSUs to be awarded to each named executive officerNEO in 20172020 was determined by determining the value of the portion of the LTCPLTIP award to be awarded as performance share unitsPSUs (determined by the

Compensation Committee as described above) using the fair market value of the stock price as of the date of grant, and then rounded to the nearest ten shares.grant. The target number of performance share unitsPSUs are increased or decreased (to an amount equal to between 40% to0% and 200% of the target number)target) after the performance period for each component.

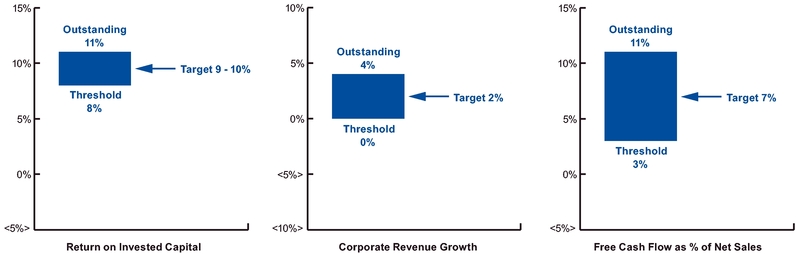

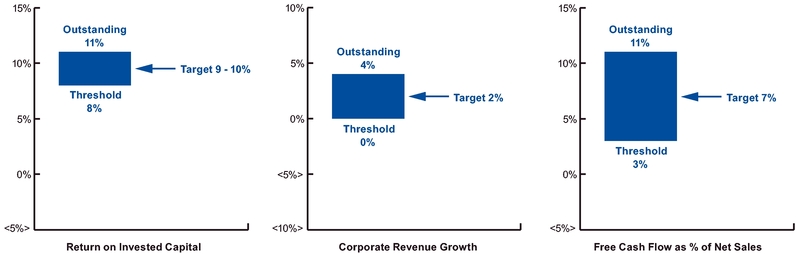

The first component ("Component I"), representing 75% of the award, is subject to a one-year performance period. The units are then subject to a two year holding period. After the end of the performance period, the adjustment of the target number of shares will arePSUs is calculated based on the Company's achievement of performance goals relative to the following equally weighted criteria: adjusted year over year growth in net sales, (constant currency)("excluding translation impacts from changes in foreign exchange rates and adjusted for acquisitions and divestitures ("Constant Currency Sales"), adjusted year over year growth in return on invested capitacapital ("Return on Capital"), and adjusted year over year growth in earnings per sharefree cash flow reflected as a percentage of net sales ("Earnings Per Share"Free Cash Flow as Percentage of Net Sales"). The earnings per share metric was added by the Company in 2017 to strengthen alignment with long-term stockholder value. Each of the metrics aremay be adjusted for certain items as further described in the performance sharePSU award agreements for the grantas filed by the Company as Exhibit 10.1 to the Quarterly Report on Form 8-K10-Q filing dated February 3, 2017.May 11, 2020. The threshold, target, and outstanding levels for salesConstant Currency Sales growth and returnReturn on capitalCapital were adjusted in 20172020 to reflect the Company's continued plans for growth through strategic acquisitions and investments in organic growth.

Neenah, Inc. 2021 Proxy Statement | 26

Table of Contents

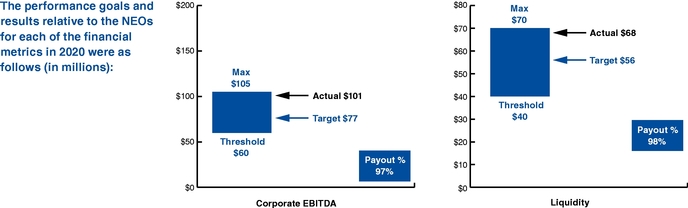

The specific targets and results in 2017 for the first componentPSU awards under the 2020 LTIP program were as follows:

| | | | | | | | | | | | | | | | |

Metric | | Threshold | | Target | | Outstanding | | 2017 Results | | Payout % | |

|---|

Payout (as a % of Target) | | | 40% | | | 100% | | | 200% | | | | | | | |

| | | | | | | | | | | | | | | | |

Return on Capital | | | Increase of

(60) basis points | | | Increase of

(25) basis points | | | Increase of

10 basis points | | | Increase of

6 basis points | | | 188 | % |

| | | | | | | | | | | | | | | | |

Constant Currency Sales | | | 3% growth | | | 6% growth | | | 9% growth | | | 3.7% | | | 23 | % |

| | | | | | | | | | | | | | | | |

Earnings Per Share | | | 3% growth | | | 7% growth | | | 11% growth | | | 7.5% | | | 113 | % |

| | | | | | | | | | | | | | | | |

Overall Payout Percentage | | | | | | | | | | | | | | | 108 | % |

Based on the process described above and our performance against the targets noted, performance share unit ("PSU") grants for the first component were awarded as follows:

| | | | | | | | | | |

| | Component I

at Target | | Component I

Earned | | % of Target

Earned | |

|---|

O'Donnell | | | 10,609 | | | 11,458 | | | 108 | % |

Lind | | | 2,096 | | | 2,264 | | | 108 | % |

Heinrichs | | | 1,633 | | | 1,764 | | | 108 | % |

Schertell | | | 2,045 | | | 2,209 | | | 108 | % |

Duncan | | | 1,074 | | | 1,160 | | | 108 | % |

The earned shares are now in a two year hold period and are still subject to forfeiture based on continued employment. All shares are scheduled to be released to active participants on December 31, 2019.

The second component ("Component II"), representing 25% of the award, is subject to a three year performance period. After the end of the performance period, the adjustment of the target number of sharesPSUs will be calculated based on the Company's achievement of performance goals during the three-year performance period and will vest on December 31, 2022.

Neenah, Inc. 2021 Proxy Statement | 27

Table of Contents

Component II Performance 2018 LTIP Awards

Component II of the 2018 LTIP award, representing 25% of the PSU award, was subject to a three-year performance period ending December 31, 2020. The target number of PSUs is calculated based on the Company's achievement of the performance goal of

Table of Contents

relative total shareholder return ("Relative TSR").TSR. The Relative TSR (including dividend yield), is compared against the Russell 2000 Value Index over the performance period.period and the target number of PSUs are increased or decreased (to an amount equal to between 40% and 200% of the target).

The specific targets and results in 2018 for Component II were as follows:

| | | | | | | | | | | | | |

Metric | | Threshold | | Target | | Outstanding | | Payout % | |

|---|

Payout (as a % of Target) | | | 40% | | | 100% | | | 200% | | | | |

Total Shareholder Return | | | 3rd Quartile | | | 2nd Quartile | | | 1st Quartile | | | TBD | * |

| | | | | | | | | | | | |

Metric |

| Threshold |

| Target |

| Outstanding |

| Payout % |

|

Payout (as a % of Target) | | 0% | | 100% | | 200% | |

|

40 |

% |

|

Total Stockholder Return | | 3rd Quartile | | 2nd Quartile | | 1st Quartile | |

|

|

|

|

Based on the process described above and our performance against the targets noted, PSU grants for Component II of the 2018 LTIP grants were awarded as follows:

| | | | | | | | | | | | | | | | |

Name(1) |

| Component II

at Target |

| Component II

Earned |

| % of Target

Earned |

|

Julie A. Schertell | | |

675 | | | |

270 | | | |

40 |

% |

|

Byron J. Racki | |

|

349 |

|

|

|

140 |

|

|

|

40 |

% |

|

Noah S. Benz | | |

169 | | | |

68 | | | |

40 |

% |

|

*(1)Subject to a 3 year performance period ending December 31, 2019In accordance with the 2018 PSU award agreement, Mr. O'Donnell and Ms. Lind forfeited Component II of the 2018 LTIP grant upon retirement.

We maintain the Neenah 401(k) Retirement Plan (the "401(k) Plan"), which is a tax-qualified defined contribution plan for employees. The 401(k) Plan is available to all Neenah's U.S. employees, but includes a special company profit-sharing contribution feature that is only applicable for certain employees who are ineligible to participate in the Pension Plan.Plan (the "Retirement Contribution Plan"). Further, we maintain a supplemental retirement contribution plan (the "Supplemental RCP") which is a non-qualified defined contribution plan which is intended to provide a tax-deferred retirement savings alternative for amounts exceeding Internal Revenue Code limitations on qualified plans. Additional information regarding the Supplemental RCP can be found in the 2017 Nonqualified"2020 Non-qualified Deferred CompensationCompensation" table later in this Proxy Statement.

We also maintain the Neenah Deferred Compensation Plan (the "Deferred Compensation Plan"), which is a non-qualified deferred compensation plan for our executive officers. The Deferred Compensation Plan enables our executive officers to defer a portion of annual cash compensation (base salary and non-equity awards under our MIP)STIP). This planThe Deferred Compensation

Plan is intended to assist our executive officers in maximizing the value of the compensation they receive from the Company and assist in their retention. Additional information regarding the Deferred Compensation Plan can be found in the 2017 Nonqualified"2020 Non-qualified Deferred CompensationCompensation" table later in this Proxy Statement.

We also maintain the Neenah Pension Plan, a tax-qualified defined benefit plan (the "Pension Plan") and the Neenah Supplemental Pension Plan, a non-qualified defined benefit plan (the "Supplemental Pension Plan") which provide tax-deferred retirement benefits for certain of our employees, includingemployees. Ms. Lind who were employed prior to December 31, 1996. Messrs. O'Donnell, Heinrichs, Duncanis the only NEO that participates in the Pension Plan and Ms. Schertell do not participate in these plans.Supplemental Pension Plan. Additional information regarding the Pension Plan and the Supplemental Pension Plan can be found in the 2017"2020 Pension BenefitsBenefits" table later in this Proxy Statement.

Neenah and the Compensation Committee believe that the Pension Plan, Supplemental Pension Plan, Retirement Contribution Plan, Supplemental RCP, Deferred Compensation Plan, and 401(k) Plan are core components of our compensation program. The plans are competitive with plans maintained by our peer companies and are necessary to attract and retain top level executive talent. Additionally, the plans support the long-term retention of key executives by providing a strong incentive for the executive to remain with

Neenah, over an extended number of years.

The Neenah Executive Severance Plan (the "Executive Severance Plan") covers designated officers, including all of our named executive officers, and provides certain severance benefits upon termination of employment following a change in control of Neenah. Upon termination of the officer's employment by Neenah without "cause" or by the officer for "good reason" (as defined in the Executive Severance Plan) within the two-year period following a change in control or a termination by us without "cause" during the one-year period preceding such a change in control, the Executive Severance Plan as in effect as of December 31, 2017 provided that the officer would be entitled to a cash payment equal to the sum of: (i) two times the sum of his annual base salary and targeted annual bonus; (ii) any qualified retirement plan benefits forfeited as a result of such termination; (iii) the

Table of Contents

amount of retirement benefits such officer would have received under the qualified and supplemental retirement plans but for his or her termination for the two-year period following his or her termination; (iv) the cost of medical and dental COBRA premiums for a period of two years; and (v) a cash settlement of any accrued retiree welfare benefits. In addition, the officer will be eligible to receive outplacement services for a period of two years (up to a maximum cost to us of $50,000).Severance Payments

In March 2017, the Compensation Committee amended the Executive Severance Planand restated its executive severance plan (the "2017 Executive Severance Plan"), effective April 1, 2017, to provide named officersexecutives certain severance benefits both upon termination of employment following a change in control of Neenah and outside of a change in control. The 2017 revisionsExecutive Severance Plan also categorize the participating officersexecutives as either "Tier 1,"1", "Tier 2", or "Tier 3" participants in order to provide varying benefit amounts to the different officers.executives. All NEOs are Tier 1 participants.participants under the 2017 Executive Severance Plan.

Upon termination of the officer'san NEO's employment by Neenah without "cause" or by the officer for "good reason" (as defined in the 2017 Executive Severance Plan) outside of a change in control, of Neenah eachsuch NEO will be entitled to an amount equal to one and one-half times his or her base salary. Upon termination of the officer'sNEO's employment by Neenah without "cause" within the two-year period following a change in control or by the officerNEO for "good reason" within the two-year period following a change in control the 2017 Executive Severance Plan provides that eachsuch terminated NEO will be entitled to the sum of (i) twoof:

(I) Two times the sum of his or her annual base salary, (ii)

(II) the amount of bonus under Neenah's Management Incentive Planthe STIP that he or she has earned through the date of the change in control, plus two times his or her targeted annual bonus; (iii)bonus,

(III) any profit-sharing contributions or pension plan benefits forfeited as a result of such termination; (iv)termination

(IV) the amount of profit-sharing contributions and pension plan benefits such participant would have received under the qualified and supplemental retirement plans but for his or her termination for the two-year period following his or her termination;termination, and (v)

(V) the cost of medical and dental COBRA premiums for a period of two years. years

In addition, each NEOssuch NEO will be fully vested in his or her account under the Deferred Compensation Plan and any awards granted to him or her under the Amended and Restated Neenah Paper, Inc. 2004 Omnibus Stock and Incentive Compensation Plan (the "2004 Omnibus Plan") or the 2018 Omnibus Plan.

In addition,Additionally, upon termination of an NEO's employment by Neenah at any time without "cause" or by the officer for "good reason" within the two-year period following a change in control,

the NEO will be eligible to receive reimbursement for outplacement service costs for a period of two years forin an amount not to exceed $50,000.

Payment of the benefits under the 2017 Executive Severance Plan is subject to the applicable executive executing an agreement that includes restrictive covenants and a general release of claims against us.Neenah. These benefits are intended to recruit and retain key executives and provide continuity in Neenah's management in the event of a change in control. We believe the 2017 Executive Severance Plan is consistent with similar plans maintained by our peer companies and, therefore, is a core component of our compensation program necessary to attract and retain key executives.

Timing of Compensation

Base salary adjustments, if any, are made by our Compensation Committee at the first meeting of each fiscal year (with the adjustments effective as of January 1 of that same year). Stock option grantsRSU awards and performance share unitPSU target levels and awards are made in the manner described above. The number of RSUs awarded is determined by the grant date fair value of the Company's stock on the day of the grant. We do not coordinate the timing of equity awards with the release of non-public information. The exercise price of the stock options is established at the fair market value of the closing price of our stock on the date of the grant.

Tax and Accounting Consideration

In general, the tax and accounting treatment of compensation for our named executive officersNEOs has not been a core component used in setting compensation. In limited circumstances, we do consider such treatment and attempt to balance the cost to Neenah against the overall goals we intend to achieve

Table of Contents

through our compensation philosophy. In particular, we have historically sought to maximize deductibility of our named executive officers'NEOs' compensation under Internal Revenue Code Section 162(m) while maintaining the flexibility necessary to appropriately compensate our executives based on performance and the existing competitive environment. The MIPSTIP and LTCPLTIP programs are performance basedperformance-based and have historically been intended to be fully deductible under Code Section 162(m).

The exemption from Section 162(m)'s deduction limit for performance-based compensation has been repealed, effective for taxable years beginning after December 31, 2017, such that compensation paid to our covered executive officers in excess of $1 million will not be deductible unless it qualifies for transition relief applicable to certain arrangements in place as of November 2, 2017.

Despite our efforts in the past to structure annual cash incentives in a manner intended to be exempt from Section 162(m) and, therefore, not subject to its deduction limits, because of ambiguities and uncertainties as to the application and interpretation of Section 162(m) and the regulations issued thereunder, including the uncertain scope of the transition relief under the legislation repealing Section 162(m)'s exemption from the deduction limit, no assurance can be given that compensation intended to satisfy the requirements for exemption from Section 162(m) in fact will.

Neenah, Inc. 2021 Proxy Statement | 29

Table of Contents

Further, the Compensation Committee reserves the right to modify compensation that was initially intended to be exempt from Section 162(m) if it determines that such modifications are consistent with our business needs.

Stock Ownership Guidelines

The Compensation Committee has adopted stock ownership guidelines to foster long-term stock holdings by company leadership. These guidelines create a strong link between stockholders' and management's interests. Named executive officersNEOs are required to own a designated multiple of their respective annual salaries.base salary. The multiples for each NEO are as follow:

| | | | | | |

| Name |

| | | Stock Ownership Multiple

Multiple of Base Salary | |

|---|

O'Donnell

| | | 6x |

|

LindJulie A. Schertell

| | | 4x

6x | | |

Paul F. DeSantis | |

|

3x |

|

|

HeinrichsByron J. Racki

| | | 4x

2x | | |

Michael W. Rickheim | |

|

2x |

|

|

SchertellNoah S. Benz

| | | 4x

2x | |

Duncan

| | | 4x | |

Each of the named executive officersNEO is required to hold at least 50% of their annual performance share grantsvested shares until they reach the ownership guidelines. The following holdings are counted toward fulfilling guidelines, with each being valued using our stock price as of December 31 of each year;year: (i) stock held in the 401(k) plan,Plan, other deferral plans, outright, or in brokerage accounts;accounts, (ii) performance share units or restricted stock unitsRSUs earned but not vested or not paid out;out, and (iii) 'in the money' value of vested or unvested stock options and SARs. Penalties for continued failure to meet the guidelines include payment of MIP compensation in Neenah stock and reduction of LTCP compensation. All of our named executive officers met or exceeded the guidelines as of December 31, 2017. Mr. Duncan was hired by the Company in 2016 and has five years in order to meet the stock ownership requirements.

CEO Pay Ratio

Under Section 953(b) of the Dodd-FrankDodd Frank Wall Street Reform and Consumer Protection Act and Item 402(u) of Regulation S-K, the Company is required to provide the ratio of the annual total compensation of Mr. O'Donnellits Chief Executive Officer, Ms. Schertell, to the annual total pay of the median employee of the Company (the "Pay Ratio Disclosure"). For 2017 Neenah'sIn 2019, the Company calculated the median compensation of all employees of the Company and its consolidated subsidiaries, (other than Mr. O'Donnell), includingwhich included employees located in the United

Table of Contents

States, Germany, The Netherlands, and England was $67,493. Mr. O'Donnell'sto be $56,116. Ms. Schertell's total compensation in 20172020 for purposes of the Pay Ratio Disclosure was $3,288,608.$2,530,027. Based on this information, for 2017, the ratio of the compensation of the Chief Executive Officer to the median annual total compensation of all other employees for purposes of the 2020 Pay Ratio Disclosure was estimated to be 4945 to 1.

The pay ratio disclosedPay Ratio Disclosure above was calculated in accordance with SEC rules based upon the Company's reasonable judgementjudgment and assumptions using the methodology described below. The SEC rules do not specify a single methodology for identification of the median employee or calculation of the pay ratio,Pay Ratio Disclosure and other companies may use assumptions and methodologies that are different from those used by the Company in calculating their pay ratio.Pay Ratio Disclosure. Accordingly, the pay ratio disclosed by other companies may not be comparable to the Company's pay ratio as disclosedPay Ratio Disclosure above. The Company's methodology for calculating the ratioPay Ratio Disclosure included the following:

- •

- Reviewed total annual cash earnings of all employees on

October 1, 2017,December 31, 2018 for our 20172018 fiscal year. This included both base pay and any overtime/premium pay earned by each employee in 2017.2018.

- •

- Permanent employee hours were annualized if they

didn'tdid not work a full year (i.e. someone working a 20 hour20-hour workweek would be annualized at 10401,040 hours a year, and someone full time would be annualized at 20802,080 hours a year). Temporary and seasonal employees were not annualized if they did not work a full year.

- •

- We identified the median employee based on total 2018 annualized earnings and then captured all 2019 pay components

based onunder the summary compensation table for such identified employee to compare to the CEO.Chief Executive Officer

- •

- Currency used to convert pay was determined as of December 31,

2017,2019 at 1.197861.1215 USD to 1 EUR, and 1.34912 USD to 1 GBP.EUR.

Clawback Policy

The Compensation Committee adopted a "clawback policy" for all executives and other employees participating in our MIPSTIP program concerning the future payment of MIPSTIP payments and long termlong-term equity grants under the LTCPLTIP program. This policy gives the Board the authority to reclaim certain overstated payments made to Neenah employees due to materially inaccurate results presented in the Company's audited financial statements.statements or if the Board concludes that such employee engaged in improper conduct.

Compensation Committee Interlocks and Insider Participation

The following directors served on the Compensation Committee during 2020: Ms. Dano, Mr. Lucas, Mr. Thene and Dr. Wood. Dr. Wood will not stand for re-election as a member of the Board of Directors at the 2021 Annual Meeting and will cease to be a member of the Compensation Committee at that time. None of the members of the Compensation Committee was an officer or employee of Neenah during 2020 or any time prior thereto, and none of the members had any relationship with Neenah during 2020 that required disclosure under Item 404 of Regulation S-K. None of our executive officers serves as a member of the board of directors or compensation committee

Neenah, Inc. 2021 Proxy Statement | 30

Table of Contents

of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Policies against Hedging and Pledging Securities

Our insider trading policy provides that directors, officers and employees are prohibited from engaging in short sales and buying or selling puts or calls or other derivative securities of Neenah. Directors and officers are also prohibited from holding Neenah securities in a margin account or pledging Neenah securities as collateral for a loan.

Neenah, Inc. 2021 Proxy Statement | 31

Table of Contents

COMPENSATION COMMITTEE REPORT

COMPENSATION COMMITTEE REPORT |

The Compensation Committee oversees Neenah's compensation policies and programs on behalf of the Board. In fulfilling this responsibility, the Compensation Committee has reviewed and discussed with Neenah's management the Compensation Discussion and Analysis included in this Proxy Statement. In reliance on such review and discussions, the Compensation Committee recommended to Neenah's Board of Directors that the Compensation Discussion and Analysis be

included in this Proxy Statement and in the Company's Annual Report on Form 10-K for the year ended December 31, 2017.2020.

Compensation Committee:

- •

- Stephen M. Wood, Chair

- •

- Margaret S. Dano

- •

- Timothy S. Lucas

- •

- Tony R. Thene

| | |

| | Compensation Committee: |

|

|

Stephen M. Wood, Chairman |

| | John F. McGovern |

| | Margaret S. Dano |

| | Timothy S. Lucas |

Neenah, Inc. 2021 Proxy Statement | 32

Table of Contents

ADVISORY VOTE ON EXECUTIVE COMPENSATION (ITEM 2)

The Board of Directors unanimously recommends that the stockholders vote "FOR" the approval of the Company's executive compensation.

Section 14A of the Securities Exchange Act of 1934, as amended (the "Exchange Act") requires that we include in this proxy statement a non-binding stockholder vote on our executive compensation as described in this proxy statement (commonly referred to as "Say-on-Pay").

We encourage stockholders to review the Compensation Discussion and Analysis ("CD&A") section of this proxy statement. Our executive compensation program has been designed to pay for performance and align our compensation programs with business strategies focused on long-term growth and creating value for stockholders while also paying competitively and focusing on total compensation. The Company's executive compensation programs are designed to attract, motivate and retain highly qualified executive officers who are able to achieve corporate objectives and create stockholder value. The Compensation Committee believes the Company's executive compensation programs reflect a strong pay-for-performance philosophy and are well aligned with the stockholders' long-term interests without promoting excessive risk. We feel this design is evidenced by the following:

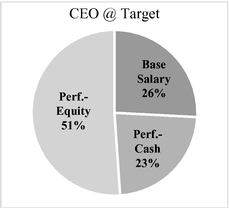

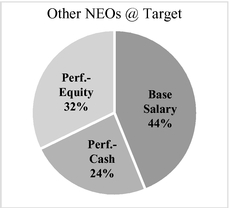

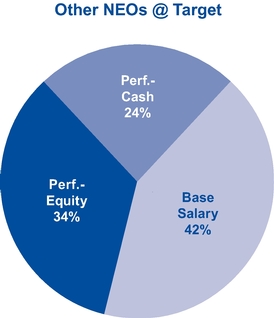

•A majority of our executives' compensation is directly linked to our performance and the creation of stockholder value. The overall compensation mix is targeted to include at least 50% performance based compensation for the named executive officers with a higher percentage of our CEO's compensation being performance based. In 2017, 74% of our CEO's compensation was performance based at target levels.

•Our long-term incentive awards are exclusively in the form of performance share units, stock options and stock appreciation rights and all of our incentive plans have capped payouts.

•LTCP grants are split with 70% of the total value of the awards granted as performance share units with a three-year vesting and a combination of one-year and three-year performance periods, and 30% as stock appreciation rights with annual vesting over a three-year period. For our performance share units, we use objective performance metrics closely tied to financial performance and shareholder value, such as increasing return on invested capital, revenue and earnings per share growth, and relative total shareholder return. In 2017 component one of the grants, representing 75% of the total grant, were awarded at 108% of target based on achieved growth in sales, return on invested capital and earnings per share. Component two, representing 25% of the grant, using total shareholder return as the metric, is subject to a three year performance period.

•Our short-term incentive plan (MIP) also is based on a pay-for-performance philosophy, with target bonus opportunities ranging from 50% to 90% of base salary based on improvements in corporate and business unit profits and successful execution of strategic objectives. In 2017, executives received a payment of 63% to 73% of target as a result of performance in corporate EBITDA, business unit EBIT and the successful execution of strategic objectives.

•We have meaningful stock ownership requirements for our named executive officers.

•We do not have employment agreements or other individual arrangements with our named executive officers that provide for a specified term of employment, compensation terms or specific benefits upon a termination of employment.

•Benefits under our Executive Severance Plan in connection with a change-in-control are payable only on a double trigger basis (i.e., following both a change in control and a qualifying termination of employment).

Table of Contents

Because the vote is advisory, it will not be binding upon the Board of Directors or the Compensation Committee and neither the Board of Directors nor the Compensation Committee will be required to take any action as a result of the outcome of the vote on this proposal. The Compensation Committee will consider the outcome of the vote when considering future executive compensation arrangements.

Table of Contents

APPROVAL OF THE NEENAH, INC. 2018 OMNIBUS STOCK AND INCENTIVE COMPENSATION PLAN (ITEM 3)

The Board of Directors unanimously recommends that the stockholders vote "FOR" the approval of the Neenah, Inc. 2018 Omnibus Stock and Incentive Compensation Plan.

The Neenah, Inc. 2018 Omnibus Stock and Incentive Compensation Plan (the "2018 Omnibus Plan") is a comprehensive incentive compensation plan that provides for various types of equity-based compensation, including incentive and nonqualified stock options, stock appreciation rights, stock awards, restricted stock units, performance share units, and performance units, in addition to dividend equivalents rights and cash awards. The purpose of the 2018 Omnibus Plan is to encourage ownership in our common stock by those employees, directors and consultants who have contributed, or are determined to be in a position to contribute, materially to our success, thereby increasing their interest in our long-term success. We believe that incentive compensation grants have been an important part of our successful employee and independent director recruiting and retention efforts to date and we expect such grants will remain a key part of this process going into the future.

The 2018 Omnibus Plan is an amendment and restatement of the Company's 2004 Omnibus Stock and Incentive Compensation Plan, as amended and restated May 30, 2013 (the "2004 Omnibus Plan").

In 2013, the Company's shareholders approved an increase of 1,577,000 shares of our common stock to be reserved for issuance under the 2004 Omnibus Plan. As of the Record Date, there remains a total of only 471,889 shares reserved for issuance under the 2004 Omnibus Plan for future awards that have not yet been awarded. In addition, as of the Record Date there are 537,246 outstanding SARs issued under the 2004 Omnibus Plan, with a weighted average term of 7.16 years and a weighted average exercise price of $63.85.

The number of shares of our common stock to be reserved for issuance for future awards under the 2018 Omnibus Plan is comprised of the 471,889 remaining shares under the 2004 Omnibus Plan as described above, plus an additional 800,000 shares of our common stock.

In addition to the 2018 Omnibus Plan providing for the above-described number of shares of common stock available for future awards, the 2018 Omnibus Plan updates the 2004 Omnibus Plan to more appropriately reflect current market practices. Accordingly, our Compensation Committee has approved the 2018 Omnibus Plan to address our needs to be able to offer equity and cash incentives going forward, subject to shareholder approval of the 2018 Omnibus Plan. NYSE listing requirements require that we submit the 2018 Omnibus Plan to our shareholders for approval. In addition, Internal Revenue Code rules require that we obtain shareholder approval of the 2018 Omnibus Plan in order to be able to issue incentive stock options under the 2018 Omnibus Plan.

The Board of Directors unanimously approved the 2018 Omnibus Plan on March 26, 2018, subject to shareholder approval. If the shareholders of the Company do not approve the 2018 Omnibus Plan, the plan will be void, any grants made under the plan (if any) will be void, and the 2004 Omnibus Plan will remain in full force and effect as prior to its amendment and restatement as the 2018 Omnibus Plan.

If approved by stockholders, the 2018 Omnibus Plan will become effective as of May 23, 2018 (the "Effective Date"), and will remain effective until terminated by the Company. This description of the 2018 Omnibus Plan below is qualified in its entirety by reference to the applicable provisions of the plan document, which is attached asAnnex A to this proxy statement.

Table of Contents

Material Changes in 2018 Omnibus Plan

The 2018 Omnibus Plan makes a number of changes to the 2004 Omnibus Plan. The primary changes are summarized below:

•The 2018 Omnibus Plan increases the number of shares of common stock that were previously available for issuance under the 2004 Plan by 800,000 shares. After this change, the number of shares available for issuance of future awards under the 2018 Omnibus Plan is the sum of the number of shares available under the 2004 Omnibus Plan for issuance of future awards immediately before the Effective Date 471,889, plus 800,000 shares. In addition, the number of shares subject to outstanding awards under the 2004 Omnibus Plan immediately before the Effective Date will remain subject to the terms of the 2004 Omnibus Plan, The maximum number of shares that can be made subject to the grant of incentive stock options is the maximum number of shares available under the 2018 Omnibus Plan. Except for the prohibition on liberal share recycling as discussed in the next paragraph, shares attributable to awards (including prior awards made under the 2004 Omnibus Plan) which expire, are forfeited or canceled or are otherwise paid or settled in cash or otherwise without the issuance of shares are again available for grant under the 2018 Omnibus Plan.

•The 2018 Omnibus Plan prohibits liberal share recycling by expanding the categories of shares that can not be recycled into the plan, consistent with best current practices. Specifically, under the 2018 Omnibus Plan, shares that have been (i) tendered or withheld to pay the exercise price of options or stock appreciation rights, (ii) withheld to satisfy tax withholding, (iii) repurchased by the Company using cash proceeds from the exercise of options or (iv) subject to a stock appreciation right or option and not issued upon net settlement or net exercise of the stock appreciation right or option, are not again eligible for issuance under the 2018 Omnibus Plan. In contrast, the 2004 Omnibus Plan provided that only in the case of options and stock appreciation rights, shares tendered by a participant or withheld by the Company to pay the option exercise price, the excess number of shares to which a stock appreciation right relates over the number of shares that are issued upon exercise of the stock appreciation right, and shares withheld or remitted by the Company to pay tax withholding, were not again available for issuance..

•The 2018 Omnibus Plan limits the amount of compensation payable to each non-employee director of the Company for service in such capacity. Specifically, the sum of the grant date fair value of awards under the plan, plus cash or other compensation that is not equity-based for any fiscal year of the Company cannot exceed $700,000 per such director. In contrast, the 2004 Omnibus Plan contained limits that applied not to the overall value of compensation a non-employee director could receive, but only to the number of shares of common stock, capping the maximum for all non-employee directors at $500,000 and capping the maximum for each non-employee director to awards per year of not more than 50,000 shares.

•The 2018 Omnibus Plan provides in general that the term "change in control," will (if used) be defined in the applicable award agreement, but provides that a liberal change in control definition cannot be used. Specifically, the plan provides that a change in control cannot be triggered upon any event that does not result in an actual change in control of the Company, such as an announcement or commencement of a tender offer or exchange offer, a potential takeover, shareholder approval (as opposed to consummation) of a merger or other transaction, acquisition of less than 15% or less of the outstanding voting securities of the Company, an unapproved change in less than a majority of the Board or other similar provisions in which the Committee determines that an actual change in control does not occur. Further, the 2018 Omnibus Plan prohibits the Committee from accelerating vesting of an award in connection with a liberal change in control definition.

Table of Contents

•The 2018 Omnibus Plan deletes many provisions that were previously in the 2004 Omnibus Plan solely to qualify certain performance-based compensation payable to named executive officers for a tax deduction under Section 162(m) of the Internal Revenue Code to the extent that the compensation exceeded $1,000,000 per year per officer. This includes, for example, deleting the incentive pool formula based on operating earnings and operating cash flow, deleting a specific list of performance goals, and deleting per officer annual limits on awards under the plan. The Compensation Committee of the Board of Directors (the "Committee") believes that these provisions no longer need to be in the plan as the exemption from Section 162(m)'s deduction limit for performance-based compensation has been repealed, effective for taxable years beginning after December 31, 2017, such that compensation paid to any of our covered executive officers in excess of $1 million will not be deductible unless it qualifies for transition relief applicable to binding written contracts that were in effect on November 2, 2017. However, the 2018 Omnibus Plan preserves the ability of the Compensation Committee to make performance-based grants, and the Committee plans to continue to do this.

•The 2018 Omnibus Plan deletes the definition of "Retirement" to provide for flexibility to specify the retirement criteria (if applicable) in an award agreement.

How the 2018 Omnibus Plan is Designed to Protect Shareholders' Interests

The following features of the 2018 Omnibus Plan are intended to continue to protect the interests of our shareholders:

•Limits on terms of options and stock appreciation rights. The maximum terms of each stock option and stock appreciation right that can be granted under the Plan is ten years.

•Limits on share recycling. As discussed above, the 2018 Omnibus Plan does not allow liberal share recycling.

•No repricing of options or stock appreciation rights. The 2018 Omnibus Plan prohibits the repricing of "underwater" options and stock appreciation rights, whether by amending an existing award, substituting a new award at a lower price or executing a cash buyout, unless specifically approved by the Company's shareholders.

•No discounted options or stock appreciation rights. The 2018 Omnibus Plan prohibits granting options or stock appreciation rights with an exercise price less than the fair market value per share of our common stock on the date of grant.

•No automatic change in control benefits. The 2018 Omnibus Plan does not provide any automatic benefits upon a change in control or any excise tax gross-ups.

•No liberal change in control definition. As discussed under the preceding title, the 2018 Omnibus Plan does not allow the use of a liberal change in control definition and prohibits accelerated vesting in connection with a liberal change in control definition.

•Limits on non-employee director compensation. As discussed under the preceding title, the 2018 Omnibus Plan places a meaningful limit on each non-employee director's annual compensation.

Summary of Other Provisions of 2018 Omnibus Plan

Eligibility. Participation in the 2018 Omnibus Plan is limited to employees, directors and consultants of Neenah, its affiliates and/or its subsidiaries.

Administration. Awards under the 2018 Omnibus Plan will be determined by the Committee. However, the Chief Executive Officer may grant awards to newly hired employees who are not officers subject to Section 16 of the Exchange Act, not to exceed 300,000 shares of common stock per year.

Table of Contents

The 2018 Omnibus Plan allows for awards to be granted in the form of incentive and nonqualified stock options, stock appreciation rights, stock awards, restricted stock units, performance share units, performance units, dividend equivalents rights and cash awards.

Options. Options may be made exercisable at a price per share not less than the fair market value, determined in accordance with the 2018 Omnibus Plan, per share of common stock on the date that the option is awarded. Options may not be repriced without shareholder approval. The Committee may permit an option exercise price to be paid in cash or by the delivery of previously-owned shares of Company Common Stock, or to be satisfied through a cashless exercise executed through a broker or by having a number of shares of Company Common Stock otherwise issuable at the time of exercise withheld. The maximum term of any option is 10 years. The Committee is permitted under the 2018 Omnibus Plan to substitute stock appreciation rights for options on the same terms as the options with an aggregate difference between the fair market value of the shares subject to the stock appreciation right and the grant price of the stock appreciation right that is equal to the aggregate difference between the fair market value of the shares subject to the option and the option exercise price. The 2018 Omnibus Plan permits the grant of both incentive and non-qualified stock options. Incentive stock options cannot be granted more than 10 years after the earlier of the adoption of the 2018 Omnibus Plan by the Board of Directors or the date the plan is approved by the shareholders of the Company.

Stock Appreciation Rights. Stock appreciation rights may have a grant price per share not less than the fair market value, determined in accordance with the 2018 Omnibus Plan, per share of common stock on the date that the option is awarded stock appreciation rights may not be repriced without shareholder approval. The maximum term of any stock appreciation right is 10 years. Stock appreciation rights may be granted separately or in connection with another award, and the Committee may provide that they are exercisable at the discretion of the holder or that they will be paid at a time or times certain or upon the occurrence or non-occurrence of certain events. Stock appreciation rights may be settled in shares of common stock or in cash, according to terms established by the Committee with respect to any particular award.

Stock Awards and Restricted Stock Units. The Committee may grant shares of common stock or the right to receive common stock in the future to a participant, subject to such restrictions and conditions, if any, as the Committee shall determine.

Performance Units and Performance Share Units. Performance units have an initial value determined by the Committee on the date of grant and performance shares have an initial value per share equal to the fair market value per share of common stock determined on the date of grant. The Committee sets the performance goals to determine the value of the number of performance units or performance shares that will be paid. Performance units and performance shares may be paid in shares of common stock or in cash as determined by the Committee.

Other Incentives. Dividend equivalent rights and cash awards may be granted in such numbers and may be subject to such conditions or restrictions as the Committee shall determine and shall be payable in cash or shares of common stock, as the Committee may determine. However, dividend equivalent rights may not be granted in connection with an option or a stock appreciation right.

Deferrals. The Committee may require or permit participants to defer the receipt of awards under the 2018 Omnibus Plan.

Recapitalizations and Reorganizations. The number of shares of common stock reserved for issuance in connection with the grant or settlement of awards or to which an award is subject, the number of shares issuable by the Chief Executive Officer as provided above under the heading "Administration," and the exercise price of each option and stock appreciation right are subject to adjustment in the event of any recapitalization of the Company or similar event effected without

Table of Contents

receipt of consideration by the Company. In the event of certain corporate reorganizations, awards may be substituted, cancelled, accelerated, cashed-out or otherwise adjusted by the Committee, provided such adjustment is not inconsistent with the express terms of the 2018 Omnibus Plan.

Transferability. Awards are not generally transferable or assignable, unless the Committee provides otherwise, but in any case, transfers for value are not permitted.

Forfeiture and Clawbacks. Awards will be subject to forfeiture to the extent provided by the Committee in the applicable award agreement. In addition, if the Company is required to prepare an accounting restatement due to the material noncompliance of the Company, as a result of misconduct, with any financial reporting requirement under the securities laws, if the participant knowingly or grossly negligently engaged in the misconduct, or knowingly or grossly negligently failed to prevent the misconduct, or if the participant is one of the individuals subject to automatic forfeiture under Section 304 of the Sarbanes-Oxley Act of 2002, the participant is required to reimburse the Company the amount of any payment in settlement of an award earned or accrued during the twelve-month period following the first public issuance or filing of the financial document. Also, each Award is subject to forfeiture to the extent provided in any applicable clawback policy adopted by the Company or otherwise required pursuant to applicable law.

Fungible Share Pool. Shares issued in respect of any Full-Value Award (i.e., stock issued pursuant to awards other than options or stock appreciation rights) granted under the 2018 Omnibus Plan shall be counted against the share limit as 2.3 shares for every one share actually issued in connection with such award. For example, if 100 shares are issued with respect to a Full-Value Award grantee, 230 shares will be counted against the share limit in connection with that award. Shares issued in respect of any other award (i.e., options and stock appreciation rights) shall be counted against the share limit as one share. Therefore, as noted previously, if stockholders approve the 2018 Omnibus Plan and all 1,271,889 shares available for future grants are granted as Full-Value Awards, the total number of shares issued under the future grants under the 2018 Omnibus Plan will be 552,995.

Amendment or Termination. The 2018 Omnibus Plan may be amended by the Board of Directors, but stockholder approval for any amendment shall be required that (except as provided above regarding recapitalizations and reorganizations), increases the number of shares of common stock available, materially expands the classes of individuals eligible to receive awards, materially expands the type of awards available, would permit option repricing or stock appreciation rights repricing, or would otherwise require stockholder approval under the rules of the applicable stock exchange. The Committee may amend outstanding awards subject to the terms of the 2018 Omnibus Plan but in general may not take away a participant's rights.

The following discussion outlines generally the federal income tax consequences of participation in the Amended Omnibus Plan. Individual circumstances may vary and each participant should rely on his or her own tax counsel for advice regarding federal income tax treatment under the plan.

Non-Qualified Options. A participant will not recognize income upon the grant of an option or at any time prior to the exercise of the option or a portion thereof. At the time the participant exercises a non-qualified option or portion thereof, he or she will recognize compensation taxable as ordinary income in an amount equal to the excess of the fair market value of the common stock on the date the option is exercised over the price paid for the common stock, and the Company will then be entitled to a corresponding deduction. Depending upon the period shares of common stock are held after exercise, the sale or other taxable disposition of shares acquired through the exercise of a non-qualified option generally will result in a short- or long- term capital gain or loss equal to the difference between the

Table of Contents

amount realized on such disposition and the fair market value of such shares when the non-qualified option was exercised.

Incentive Stock Options. A participant who exercises an incentive stock option will not be taxed at the time he or she exercises the option or a portion thereof. Instead, he or she will be taxed at the time he or she sells the common stock purchased pursuant to the option. The participant will be taxed on the difference between the price he or she paid for the stock and the amount for which he or she sells the stock. If the participant does not sell the stock prior to two years from the date of grant of the option and one year from the date the stock is transferred to him or her, the participant will be entitled to capital gain or loss treatment based upon the difference between the amount realized on the disposition and the aggregate exercise price and the Company will not get a corresponding deduction. If the participant sells the stock at a gain prior to that time, the difference between the amount the participant paid for the stock and the lesser of the fair market value on the date of exercise or the amount for which the stock is sold, will be taxed as ordinary income and the Company will be entitled to a corresponding deduction; if the stock is sold for an amount in excess of the fair market value on the date of exercise, the excess amount is taxed as capital gain. If the participant sells the stock for less than the amount he or she paid for the stock prior to the one or two year periods indicated, no amount will be taxed as ordinary income and the loss will be taxed as a capital loss. Exercise of an incentive option may subject a participant to, or increase a participant's liability for, the alternative minimum tax.

Restricted Stock. A participant will not be taxed upon the grant of a restricted stock award if such award is not transferable by the participant or is subject to a "substantial risk of forfeiture," as defined in the Internal Revenue Code. However, when the shares of common stock that are subject to the stock award are transferable by the participant and are no longer subject to a substantial risk of forfeiture, the participant will recognize compensation taxable as ordinary income in an amount equal to the fair market value of the stock subject to the stock award, less any amount paid for such stock, and the Company will then be entitled to a corresponding deduction. However, if a participant so elects at the time of receipt of a stock award, he or she may include the fair market value of the stock subject to the stock award, less any amount paid for such stock, in income at that time and the Company also will be entitled to a corresponding deduction at that time.

Other Stock Incentives. A participant will not recognize income upon the grant of any other stock-based award. Generally, at the time a participant receives payment under any other stock-based award, he or she will recognize compensation taxable as ordinary income in an amount equal to the cash or the fair market value of the common stock received, and the Company will then be entitled to a corresponding deduction.

Benefits under the 2018 Omnibus Plan

Future awards under the 2018 Omnibus Plan will be subject to the discretion of the Committee and will depend on a variety of factors, including the value of the Company's stock at the time of grant, as well as Company, divisional, and individual performance. Accordingly, it is not possible to determine the benefits that would be received under the 2018 Omnibus Plan.

Table of Contents

Equity Compensation Plan Information

The following table summarizes information about outstanding options, share appreciation rights and restricted stock units and shares reserved for future issuance under our existing equity compensation plans as of December 31, 2017.

| | | | | | | | | | |

Plan Category | | (a)

Number of

securities

to be issued upon

exercise of

outstanding

options,

warrants, and

rights | | (b)

Weighted-average

exercise price

of

outstanding

options,

warrants, and

rights(1) | | (c)

Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column

(a)) | |

|---|

Equity compensation plans approved by security holders | | | 310,176 | (2)(3) | | 55.60 | | | 680,000 | (4) |

Equity compensation plans not approved by security holders | | | N/A | | | N/A | | | N/A | |

| | | | | | | | | | | |

Total | | | 310,176 | | | 55.60 | | | 680,000 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1)The weighted-average exercise price of outstanding options, warrants and rights does not take into account restricted stock units since they do not have an exercise price.

(2)Includes (i) 180,000 shares issuable upon the exercise of outstanding SARs, (ii) 41,377 shares issuable following the vesting and conversion of outstanding performance unit awards, and (iii) 88,799 shares issuable upon the vesting and conversion of outstanding RSUs, all as of December 31, 2017. As of December 31, 2017, we had an aggregate of 464,958 stock options and SARs outstanding. The weighted average exercise price of the stock options and SARs was $55.60 per share.

(3)Includes 159,200 shares that would be issued upon the assumed exercise of 425,200 SARs at the price of $90.65 per share closing price of our common stock on December 31, 2017.

(4)Represents 680,000 shares available for future issuance under our 2004 Omnibus Plan as of December 31, 2017.

ADDITIONAL EXECUTIVE COMPENSATION INFORMATION |

Table of Contents

ADDITIONAL EXECUTIVE COMPENSATION INFORMATION

Summary Compensation Table

The following table reflects compensation paid to or earned by our named executive officersNEOs for services rendered during 2017, 20162020, 2019, and 2015:2018:

| | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary

($) | | Stock

Awards

($)(1) | | Option

Awards

($)(2) | | Non-Equity

Incentive Plan

Compensation

($)(3) | | Change in

Pension

Value and

Non-Qualified

Deferred

Compensation

Earnings

($)(4) | | All Other

Compensation

($)(5) | | Total

($) | |

|---|

John P. O'Donnell | | | 2017 | | | 830,000 | | | 1,351,979 | | | 498,003 | | | 472,478 | | | 0 | | | 136,148 | | | 3,288,608 | |

President and | | | 2016 | | | 750,000 | | | 1,103,789 | | | 382,495 | | | 577,500 | | | 0 | | | 150,573 | | | 2,964,357 | |

Chief Executive Officer | | | 2015 | | | 625,000 | | | 878,890 | | | 287,237 | | | 850,000 | | | 0 | | | 133,766 | | | 2,774,893 | |

Bonnie C. Lind | | |

2017 | | |

410,000 | | |

267,146 | | |

98,400 | | |

155,595 | | |

695,393 | | |

10,300 | | |

1,636,834 | |

Senior Vice President, Chief | | | 2016 | | | 370,000 | | | 240,238 | | | 83,249 | | | 195,869 | | | 386,467 | | | 10,150 | | | 1,285,973 | |

Financial Officer and Treasurer | | | 2015 | | | 346,000 | | | 242,340 | | | 79,221 | | | 322,575 | | | 410,095 | | | 9,930 | | | 1,410,161 | |

Steven S. Heinrichs | | |

2017 | | |

365,000 | | |

208,078 | | |

76,652 | | |

115,431 | | |

0 | | |

47,128 | | |

812,289 | |

Senior Vice President, General | | | 2016 | | | 330,000 | | | 185,697 | | | 64,348 | | | 158,813 | | | 0 | | | 54,315 | | | 793,173 | |

Counsel and Secretary | | | 2015 | | | 310,000 | | | 188,753 | | | 61,763 | | | 263,500 | | | 0 | | | 52,517 | | | 876,533 | |

Julie A. Schertell | | |

2017 | | |

400,000 | | |

260,647 | | |

96,002 | | |

161,150 | | |

0 | | |

53,152 | | |

970,951 | |

Senior Vice President, | | | 2016 | | | 360,000 | | | 233,716 | | | 81,006 | | | 182,655 | | | 0 | | | 68,477 | | | 925,854 | |

President Fine Paper & Packaging | | | 2015 | | | 336,000 | | | 220,745 | | | 72,139 | | | 416,724 | | | 0 | | | 53,623 | | | 1,009,231 | |

Matthew L. Duncan(6) | | |

2017 | | |

280,000 | | |

136,871 | | |

50,406 | | |

88,550 | | |

0 | | |

32,943 | | |

588,770 | |

Senior Vice President, Chief | | | 2016 | | | 234,444 | | | 245,482 | | | 50,394 | | | 101,725 | | | 0 | | | 23,841 | | | 655,886 | |

Human Resources Officer | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name |

| Year |

| Salary

($)(1) |

| Bonus($) |

| Stock

Awards

($)(2) |

| Option

Awards

($)(3) |

| Non-Equity

Incentive

Plan

($)(4) |

| Change in

Pension

Value

($)(5) |

| All Other

Compensation

($)(6) |

| Total

($) | |

O'Donnell (ret.) |

|

2020 |

|

398,669 |

|

|

— |

|

|

1,725,971 |

|

— |

|

|

89,700 |

|

|

|

— |

|

|

|

108,862 |

|

|

2,323,202 |

|

|

|

2019 |

|

863,000 |

|

|

— |

|

|

1,781,928 |

|

— |

|

|

516,506 |

|

|

|

— |

|

|

|

104,260 |

|

|

3,265,694 |

|

|

|

2018 |

|

830,000 |

|

|

— |

|

|

1,310,184 |

|

498,004 |

|

|

186,750 |

|

|

|

— |

|

|

|

138,182 |

|

|

2,963,120 |

|

Schertell |

|

2020 |

|

673,333 |

|

|

— |

|

|

1,369,332 |

|

— |

|

|

415,056 |

|

|

|

— |

|

|

|

72,306 |

|

|

2,530,027 |

|

|

|

2019 |

|

460,000 |

|

|

— |

|

|

427,425 |

|

— |

|

|

111,780 |

|

|

|

— |

|

|

|

54,155 |

|

|

1,053,360 |

|

|

|

2018 |

|

415,000 |

|

|

— |

|

|

270,736 |

|

108,006 |

|

|

67,860 |

|

|

|

— |

|

|

|

53,999 |

|

|

915,601 |

|

Lind (ret.) |

|

2020 |

|

309,773 |

|

|

20,000 |

|

|

445,207 |

|

— |

|

|

137,539 |

|

|

|

875,753 |

|

|

|

13,265 |

|

|

1,801,537 |

|

|

|

2019 |

|

435,000 |

|

|

— |

|

|

449,071 |

|

— |

|

|

173,565 |

|

|

|

332,092 |

|

|

|

14,650 |

|

|

1,404,378 |

|

|

|

2018 |

|

410,000 |

|

|

— |

|

|

291,322 |

|

110,696 |

|

|

61,500 |

|

|

|

121,523 |

|

|

|

22,080 |

|

|

1,017,121 |

|

DeSantis |

|

2020 |

|

296,627 |

|

|

— |

|

|

718,879 |

|

— |

|

|

142,678 |

|

|

|

— |

|

|

|

19,600 |

|

|

1,177,784 |

|

Racki |

|

2020 |

|

391,667 |

|

|

— |

|

|

307,067 |

|

— |

|

|

159,408 |

|

|

|

— |

|

|

|

49,139 |

|

|

907,281 |

|

|

|

2019 |

|

377,000 |

|

|

— |

|

|

291,903 |

|

— |

|

|

227,143 |

|

|

|

— |

|

|

|

37,289 |

|

|

933,335 |

|

|

|

2018 |

|

326,750 |

|

|

— |

|

|

146,878 |

|

55,806 |

|

|

68,288 |

|

|

|

— |

|

|

|

41,993 |

|

|

639,715 |

|

Rickheim |

|

2020 |

|

251,231 |

|

|

100,000 |

|

|

441,101 |

|

— |

|

|

111,547 |

|

|

|

— |

|

|

|

20,074 |

|

|

923,953 |

|

Benz |

|

2020 |

|

353,479 |

|

|

— |

|

|

240,166 |

|

— |

|

|

130,787 |

|

|

|

— |

|

|

|

34,314 |

|

|

758,746 |

|

|

|

2019 |

|

310,000 |

|

|

— |

|

|

208,026 |

|

— |

|

|

103,075 |

|

|

|

— |

|

|

|

27,461 |

|

|

648,562 |

|

|

|

2018 |

|

248,438 |

|

|

— |

|

|

61,629 |

|

26,994 |

|

|

26,309 |

|

|

|

— |

|

|

|

26,654 |

|

|

390,024 |

|

- (1)

- Amounts shown reflect actual earnings during the applicable year and include mid-year salary adjustments. Please see the "Compensation Discussion & Analysis" section of this Proxy Statement for base salary information for each NEO as of December 31, 2020.

- (2)

- Amounts shown reflect the aggregate grant date fair value with respect to

performance share units, restricted stock unitsPSUs and restricted stockRSUs granted pursuant to ourthe 2004 Omnibus Plan and 2018 Omnibus Plan. The amounts represent the grant date fair value of the PSU and RSU awards in accordance with ASC 718. The grant date fair value of the stock awards is equal to the fair

market value of the underlying common stock on the date of grant. See Note 98 of Notes to the auditedConsolidated Financial StatementStatements included in our 20172020 Annual Report on Form 10-K for the assumptions used in valuing the performance share units.

PSUs and RSUs granted.

(2)(3)- Amounts shown reflect the aggregate grant date fair value with respect to

stock options and stock appreciation rights ("SAR")SARs granted pursuant to ourthe 2004 Omnibus Plan and 2018 Omnibus Plan. The amounts represent grant date fair value of the SARs in accordance with ASC 718. The grant date fair value of the SAR awards is determined using the Black-Scholes

Neenah, Inc. 2021 Proxy Statement | 33

Table of Contents

- option valuation model. See Note

98 of Notes to the auditedConsolidated Financial StatementStatements included in our 20172020 Annual Report on Form 10-K for the assumptions used in valuing the SARs.

SARs granted.

(3)(4)- Amounts shown reflect annual performance bonuses earned in the fiscal year and paid in the following

year, andyear. 2020 amounts are described in detail in the portion of our Compensation"Compensation Discussion and Analysis,Analysis" captioned "2017"2020 Annual Performance Bonus Awards."

(4)(5)- Change in Pension Value and Non-qualified Deferred Compensation Earnings. Amounts shown reflect the aggregate change during the year in the actuarial present value of accumulated benefit under our Pension Plan and Supplemental Pension Plan. The large variability in value year-to-year is caused, for the most part, by changes in the discount rates used to calculate the value from

year to year,year-to-year, and not any increase or change in the pension plan for any individual named executive officer.NEO. Messrs. Heinrichs, Duncan,Racki, Benz, O'Donnell, Rickheim, DeSantis and Ms. Schertell do not participate in any ofeither the defined pension plans.

Pension Plan or Supplemental Pension Plan.

(5)(6)- "All Other Compensation"

only includes the following items: Neenah's contribution to the 401(k) account of each of our named executive officers. The amounts shown for Messrs. Heinrichs, O'Donnell, Duncan and Ms. Schertell also include Neenah's special company profit-sharing contribution to their accounts in the 401(k) Plan and Supplemental Retirement Contribution PlanRCP account of our NEOs as follows (as further disclosed on page 4942 of this Proxy Statement. Statement):

| | | | | | | | | | |

Name |

| Year |

| Amount ($) |

| |

John P. O'Donnell (ret.) | |

2020 |

|

|

106,562 |

|

|

|

| | 2019 | | | 98,260 | | | |

| | 2018 | | | 120,291 | | | |

Julie A. Schertell | |

2020 | | |

71,256 | | |

|

| | 2019 | | | 49,955 | | | |

| | 2018 | | | 49,535 | | | |

Paul F. DeSantis | |

2020 |

|

|

17,100 |

|

|

|

Byron J. Racki | |

2020 | | |

47,254 | | |

|

| | 2019 | | | 36,464 | | | |

| | 2018 | | | 34,788 | | | |

Michael W. Rickheim | |

2020 |

|

|

15,074 |

|

|

|

Noah S. Benz | |

2020 | | |

34,312 | | |

|

| | 2019 | | | 27,460 | | | |

| | 2018 | | | 24,910 | | | |

The amounts shown for Ms. Lind, Mr. Heinrichs, Duncan, and Ms. Schertell in 2017, 2016, and 2015the "All Other Compensation" column also include expenses forthe following categories of perquisites: annual physicals, tax preparation, financial planning and financial planning.

(6)Mr. Duncan was hired byspousal travel to attend the Company on February 29, 2016.

Neenah, Inc. 2021 Proxy Statement | 34

Table of Contents

20172020 Grants of Plan Based Awards

The following table contains information relating to the plan based awards grants made in 20172020 to our named executive officersNEOs under the 2018 Omnibus Plan and is intended to supplement the 2017 Summary"Summary Compensation TableTable" listed above.above:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| | All Other

Option

Awards

(3) | |

| |

| |

|---|

| |

| |

| | Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards(1) | | Estimated Future Payouts

Under Equity Incentive

Plan Awards(2) | |

| |

| |

|---|

| |

| |

| | Exercise

or Base

Price of

Option

Award

($/SH) | | Grant Date

Fair

Value of

Stock and

Option

Awards

($) | |

|---|

Name and

Principal Position | | Plan | | Grant

Date | | Threshold

($) | | Target

($) | | Maximum

($) | | Threshold

(#) | | Target

(#) | | Maximum

(#) | | Number of

Securities

Underlying

Options

(#) | |

|---|

John P. O'Donnell | | MIP | | | 01/30/2017 | | | 0 | | | 747,000 | | | 1,494,000 | | | | | | | | | | | | | | | | | | | |

President and Chief | | PSU | | | 01/30/2017 | | | | | | | | | | | | 5,658 | | | 14,145 | | | 28,290 | | | | | | | | | 1,351,979 | |

Executive Officer | | SAR | | | 01/30/2017 | | | | | | | | | | | | | | | | | | | | | 36,753 | | | 82.15 | | | 498,003 | |

Bonnie C. Lind | |

MIP | | |

01/30/2017 | | |

0 | | |

246,000 | | |

492,000 | | | | | | | | | | | | | | | | | | | |

Senior Vice President, | | PSU | | | 01/30/2017 | | | | | | | | | | | | 1,118 | | | 2,795 | | | 5,590 | | | | | | | | | 267,146 | |

Chief Financial Officer | | SAR | | | 01/30/2017 | | | | | | | | | | | | | | | | | | | | | 7,262 | | | 82.15 | | | 98,400 | |

and Treasurer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Steven S. Heinrichs | |

MIP | | |

01/30/2017 | | |

0 | | |

182,500 | | |

365,000 | | | | | | | | | | | | | | | | | | | |

Senior Vice President, | | PSU | | | 01/30/2017 | | | | | | | | | | | | 871 | | | 2,177 | | | 4,354 | | | | | | | | | 208,078 | |

General Counsel and | | SAR | | | 01/30/2017 | | | | | | | | | | | | | | | | | | | | | 5,657 | | | 82.15 | | | 76,652 | |

Secretary | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Julie A. Schertell | |

MIP | | |

01/30/2017 | | |

0 | | |

220,000 | | |

550,000 | | | | | | | | | | | | | | | | | | | |

Senior Vice President, | | PSU | | | 01/30/2017 | | | | | | | | | | | | 1,091 | | | 2,727 | | | 5,454 | | | | | | | | | 260,647 | |

President Fine | | SAR | | | 01/30/2017 | | | | | | | | | | | | | | | | | | | | | 7,085 | | | 82.15 | | | 96,002 | |

Paper & Packaging | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Matthew L. Duncan | |

MIP | | |

01/30/2017 | | |

0 | | |

140,000 | | |

280,000 | | | | | | | | | | | | | | | | | | | |

Senior Vice President, | | PSU | | | 01/30/2017 | | | | | | | | | | | | 573 | | | 1,432 | | | 2,864 | | | | | | | | | 136,871 | |

Chief Human Resources Officer | | SAR | | | 01/30/2017 | | | | | | | | | | | | | | | | | | | | | 3,720 | | | 82.15 | | | 50,406 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards(1) |

|

| Estimated Future Payouts

Under Equity Incentive

Plan Awards(2) |

|

| All Other

Stock

Awards(3) |

|

| Grant |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name |

| Plan |

|

| Grant

Date |

|

| Threshold

($) |

|

| Target

($) |

|

| Maximum

($) |

|

| Threshold

(#) |

|

| Target

(#) |

|

| Maximum

(#) |

|

| # of

Securities

Underlying

Stock

Awards

(#) |

|

| Date

Fair

Value of

Stock

Awards

($) |

| |

John P. O'Donnell (ret.) | | STIP | |

|

2/4/2020 |

|

|

0 |

|

|

776,700 |

|

|

1,553,400 |

|

|

|

|